Encompass from ICE Mortgage Technology - Reviews, Pricing, Features

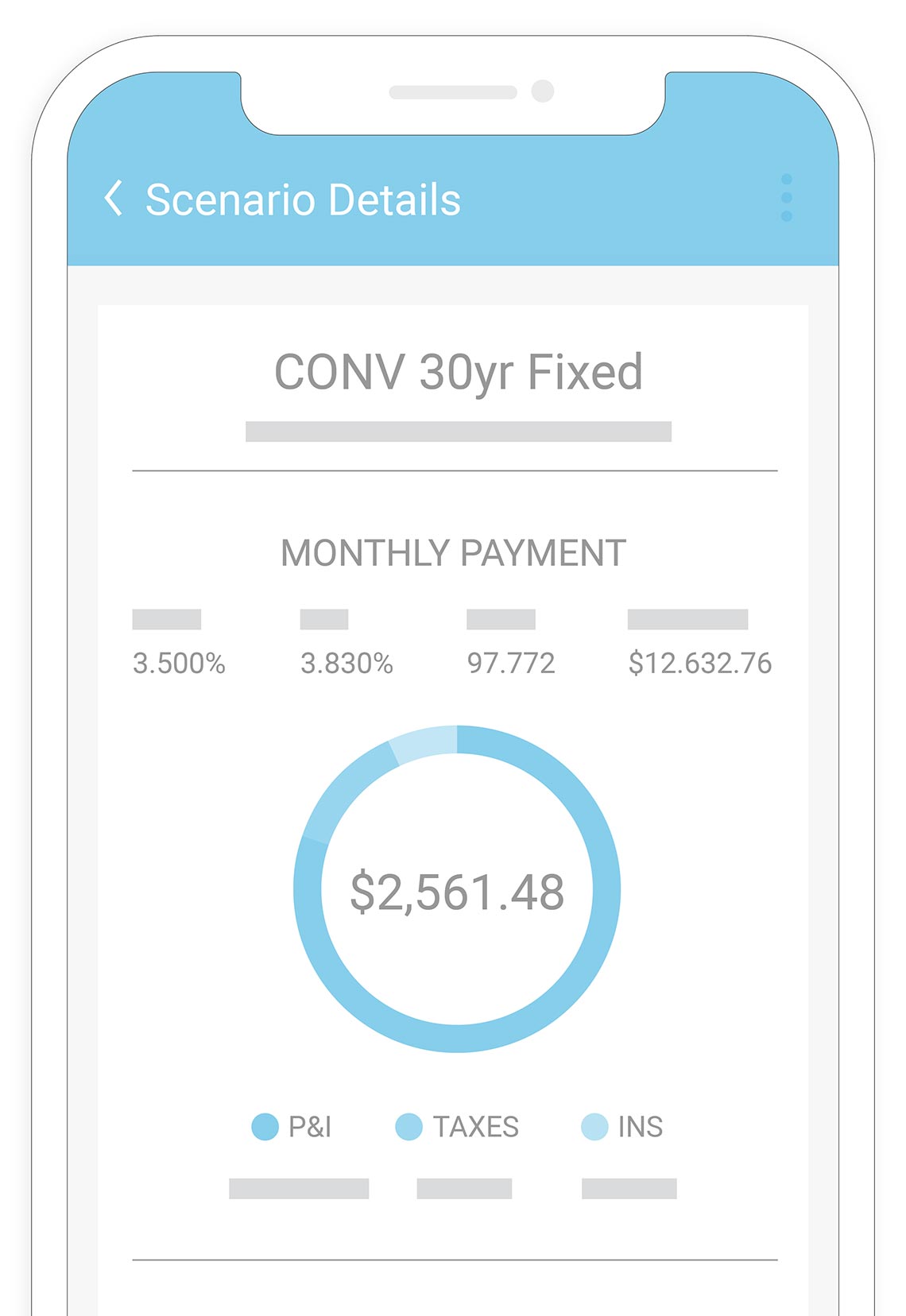

Encompass from ICE Mortgage Technology offers an all-in-one digital mortgage solution designed to optimize lending and investing at scale. The platform delivers proven ROI, seamless workflows, and industry-leading data insights to drive better decision-making and profitability for lenders.

With its comprehensive features, including customer engagement solutions, efficient loan origination and closing processes, secondary marketing support, and robust data and analytics capabilities, Encompass from ICE Mortgage Technology is the ultimate choice for lenders seeking to enhance their mortgage operations.

- All-in-one mortgage management solution

- Proven ROI with significant increase in gross profit per loan

- Seamless, configurable task-based workflows

- Industry-leading data and analytics for informed decision-making

Pricing

Encompass from ICE Mortgage Technology offers a competitive pricing model tailored to meet the needs of lenders of all sizes. The platform's proven ROI and efficiency enhancements make it a cost-effective choice for optimizing lending operations.

Reviews

User feedback on Encompass from ICE Mortgage Technology consistently highlights its ability to streamline loan origination, improve loan quality, and deliver an excellent customer experience. Lenders appreciate the seamless workflows and comprehensive data insights that drive better decision-making.

Features

Encompass from ICE Mortgage Technology stands out with its all-in-one design, task-based workflows, and industry-leading technology. The platform offers robust customer engagement solutions, efficient loan origination and closing processes, comprehensive secondary marketing support, and powerful data and analytics capabilities for strategic advantage.

Benefits

Implementing Encompass from ICE Mortgage Technology brings significant benefits to lenders, including improved operational efficiency, reduced cycle times, and streamlined loan servicing. The platform also enables lenders to make informed, data-driven decisions for smarter long-term business growth.

Use Cases

Encompass from ICE Mortgage Technology is ideal for lenders looking to optimize their mortgage lending operations, improve profitability, and enhance the overall borrower experience. Whether you are a bank, credit union, or mortgage company, the platform provides the tools necessary to drive innovation and success in the lending industry.

Encompass from ICE Mortgage Technology

Similar

List of Top Loan Servicing Software 2024| Logo | Name |

|---|---|

|

LoanPro |

|

FinnOne Neo |

|

TValue |

|

Calyx Point |

|

The Mortgage Office |

|

CoreLogic Credco |

|

Nortridge Loan System |

|

Mortgage Servicer |