CoreLogic Credco Reviews 2024: Pros, Cons & Pricing

CoreLogic Credco is a comprehensive mortgage management solution offering robust data management, efficient customer communication, and scalable lending options. With seamless integration capabilities and a user-friendly interface, it is an ideal choice for lenders looking to enhance their mortgage management processes.

The software's transparent pricing model and positive user reviews make it a cost-effective and reliable solution for mortgage professionals.

- Comprehensive mortgage management solution

- Robust data management and verification tools

- API-based and fully scalable lending solution

- Efficient customer communication and reporting features

Pricing

CoreLogic Credco offers competitive pricing packages tailored to the specific needs of lenders. The transparent pricing model ensures that users only pay for the features and services they require, making it a cost-effective solution for mortgage management.

Reviews

User reviews of CoreLogic Credco highlight its all-in-one mortgage management capabilities, efficient data management tools, and scalable lending solutions. Customers appreciate the comprehensive features and seamless communication offered by the software.

Features

CoreLogic Credco provides a wide range of features including robust data management, efficient customer communication, comprehensive reporting, and API-based lending solutions. The software's scalability and flexibility make it an ideal choice for lenders looking for an all-encompassing mortgage management solution.

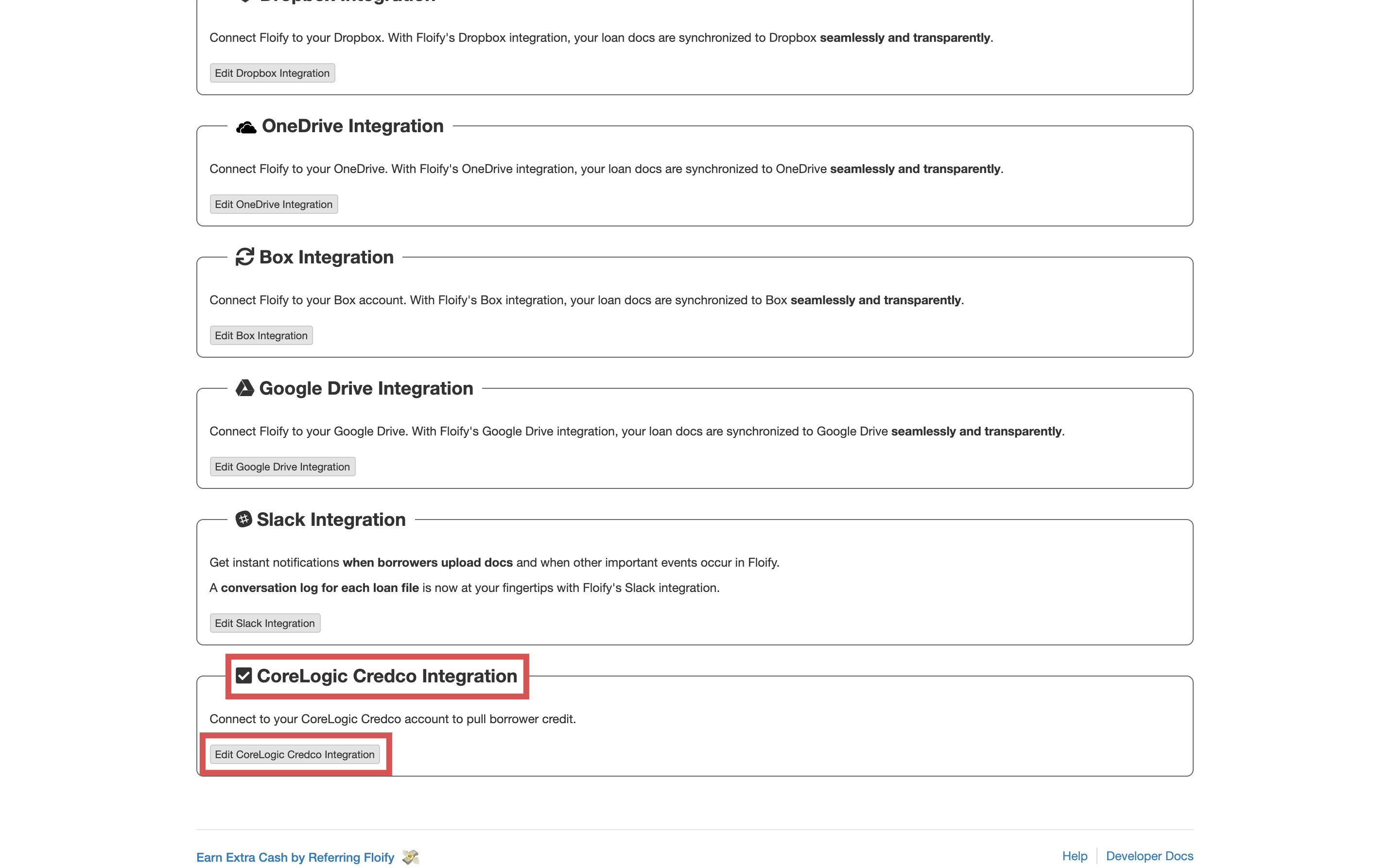

Integration

CoreLogic Credco seamlessly integrates with existing systems and offers API-based solutions to ensure smooth data flow and interoperability. The software's integration capabilities make it easy for lenders to streamline their operations and enhance workflow efficiency.

User Experience

Users appreciate the user-friendly interface and intuitive design of CoreLogic Credco. The software's efficient customer communication tools and reporting features enhance the overall user experience, making it a preferred choice for lenders seeking a comprehensive mortgage management solution.